Check Onboard

Automated onboarding for companies, employees, and contractors

Check Onboard ("Onboard") is an automated onboarding experience that is reliable, secure, and quick to implement. It enables a click-through experience for employers, employees, and contractors to link a bank account, and authorize Check to transfer funds and collect taxes, so you can focus on owning and tailoring the day-to-day payroll experience.

Check Onboard mitigates your security and compliance risk by capturing sensitive Personally Identifiable Information (PII) for you. For example, Check Onboard captures employee and contractor Social Security Numbers and exposes only the last four digits in your system.

Onboard link expirationTo ensure that access to employee and employer information via Check Onboard remains secure, Check Onboard links are one-time use only and expire after 24 hours. Check also provides an automated feature that sends an email prompt to the signatory's email with a refresh link to the same component upon expiration. This will automatically be enabled on all partner integrations moving forward, if you are an existing partner that is interested in enabling this feature, please reach out to us at [email protected].

Onboard handles the following steps for companies, employees, and contractors:

- Payment method setup: Check Onboard collects payment processing information from employers, employees, and contractors. Our integration with Plaid ensures that all bank routing information is correct and passes securely to us for payroll processing.

- Identity verification: Employees and contractors are required to submit their TIN, allowing Check to file all required tax forms on your behalf, reducing employers’ compliance and security risks.

- Tax configuration: Check Onboard captures federal and state tax forms, allowing Check to calculate, remit, and file taxes accurately.

- Withholding configuration: Check Onboard allows employees to configure their tax withholdings (filing status, allowances, and dependents) in order for Check to calculate, remit, and file taxes accurately.

- Authorizations: We require explicit authorization from companies, employees, and contractors to allow Check to transfer funds and file taxes.

Customizing Check OnboardCheck Onboard's logo and primary color can both be customized to your needs. Reach out to the Check team, and we will happily help you set it up!

Check Onboard workflow

Use Check Onboard after creating companies, employees, and contractors, but before running payroll.

- Use the Check API to create companies, workplaces, employees, and contractors.

- Use Check Onboard to collect company, employee, and contractor banking and tax information.

- Use the Check API to run payroll

- Use the Check API to generate paystubs and payroll reporting

While developing against Check's sandbox environment, Onboard is optional. However, you'll want to make sure you've set up and tested Onboard before going live. If you attempt to add an employee or contractor to a payroll before they have completed Check Onboard, they may not be able to be paid by direct deposit, or they may have more taxes withheld than intended.

There are similar but separate flows for onboarding companies, employees, and contractors.

Repeating Check Onboard

A company, employee, or contractor may have to repeat Check Onboard to update their setup. The most likely scenario for this is if a new company workplace was opened up in a new jurisdiction (county or state).

To be aware of these changes before running into errors during payroll, read the onboard.status field on the company, employee, or contractor. If it's not completed, surface an alert and redirect the company, employee, or contractor back to Check Onboard. Check will automatically direct them to the specific set of steps required.

Onboard statusTo be aware of the onboarding status of the company, employee, or contractor, read the

onboardobject on the company, employee, or contractor. For more information on theonboardobject, see the onboard status guide.

Onboarding companies

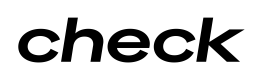

Check Onboard for companies captures the information required to link a company bank account for use in payroll, complete the required tax forms and information, and authorize Check to process payroll and submit all required state and federal taxes on behalf of the company.

First, generate a one-time Onboard link for the company. To generate this link, Check requires the full name, title, and email address of the person who has permission to onboard on behalf of the company. (This person will vary by company, but is often the head of payroll or HR.) All requests to generate Onboard links should be server-side.

Use the returned URL to redirect the named employee to the Check Onboard workflow.

Create company Onboard link

curl -X POST https://sandbox.checkhq.com/companies/{company_id}/onboard \

-H 'Content-Type: application/json'

-H 'Authorization: Bearer {API_KEY}'

-d '{

"signer_name": "Pepper Potts",

"signer_title": "CEO",

"email": "[email protected]"

}'Create company Onboard link with a Signatory object

curl -X POST https://sandbox.checkhq.com/companies/{company_id}/onboard \

-H 'Content-Type: application/json'

-H 'Authorization: Bearer {API_KEY}'

-d '{

"signatory": "sig_123"

}'Note: Onboard links are active for 24 hours, and may be regenerated if required.

Clicking the link will launch the Check Company Onboard flow.

State tax and authorization forms will be presented that are specific to the company’s location, as defined in the Company object.

Check Onboard walks company representatives through the steps necessary to capture the following information:

- Payment method: Users are asked to select a bank, and enter the username and password for the account. Or, they may use their routing information to initiate two microtransactions to confirm the account.

- Set up taxes: Users are asked to enter their Federal Employer Identification Number, and any required state information, including the state’s Employer Unemployment EIN, Employee Withholding EIN, state unemployment insurance tax rates, deposit schedules, and any locality-specific information.

- Authorize filing: Users are asked to review and authorize any applicable federal and state forms required for Check to manage payroll and file taxes on their behalf, including Federal Form 8655.

When completed, Check Onboard will create the Bank Account object, and associate it with the company.

Onboarding employees

Check Onboard for employees securely captures the information required to initiate direct deposit or cash payments, calculate taxes and withholdings, and authorize Check to process payment on their behalf.

Please note that once captured through Check Onboard, only the last four digits of an employee’s Social Security Number (SSN) will be available through the Check API.

First, generate a one-time Onboard link for the employee. Note that the employee’s name and email address are not included in this call, as they were captured when creating the employee resource. All requests to generate Onboard links should be server-side.

Use the returned URL to redirect the employee to the Check Onboard workflow.

Create employee onboard link

curl -X POST https://sandbox.checkhq.com/employees/{employee_id}/onboard \

-H 'Content-Type: application/json'

-H 'Authorization: Bearer {API_KEY}'Note: Onboard links are active for 24 hours, and may be regenerated if required.

Clicking the link will launch the Check Employee Onboard flow.

Check Onboard captures the following information when onboarding employees:

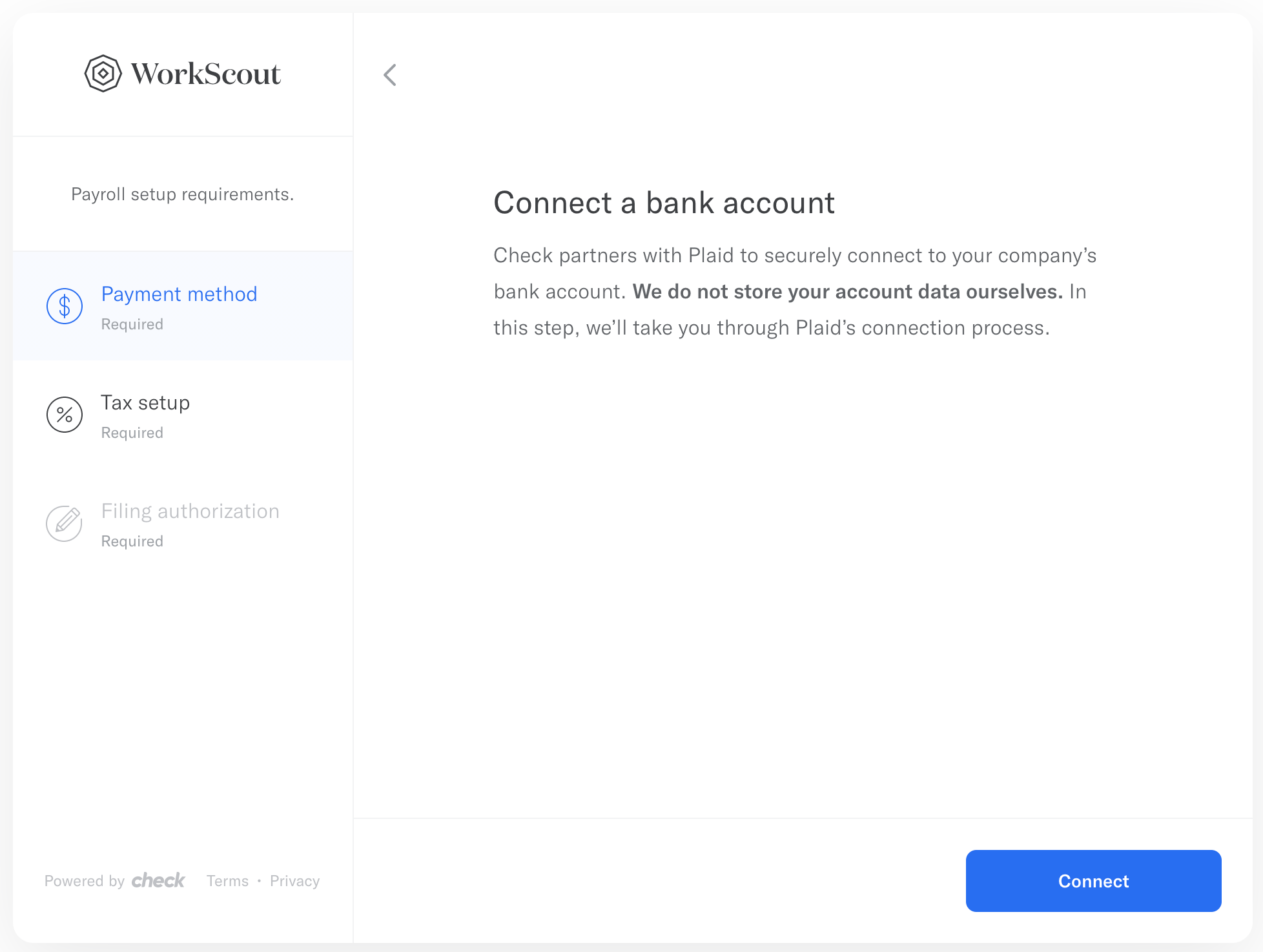

- Payment method: Users are asked to select manual (cash or check) or direct deposit payments. If they select manual, they are asked to certify that their employer has agreed to pay them directly. If they select direct deposit, they are asked to submit their banking information and authorize Check to process their paychecks. They are also notified that their routing information is encrypted and secure.

- Provide SSN: Users are asked to enter their SSN or their Individual Taxpayer Identification Number (ITIN) if they don’t have an SSN.

- Set up your withholdings: Users are asked to review and complete a federal W-4 and any applicable state withholding forms.

After completing the required fields, users are notified that they may return to enter any desired changes.

When completed, Check Onboard will create the Bank Account object, and associate it with the employee. Check will also populate the ssn_last_four attribute in the Employee object.

If an employee has not yet completed Check Onboard, you will still be able to create payroll resources for them. However, if they have not submitted direct deposit information, they will need to be paid manually (by cash or paper check), and if they have not submitted their withholdings information, then the amount of tax withheld may be greater than the employee intends. If they have not submitted their SSN, they will be unable to be paid.

Onboarding contractors

Check Onboard for contractors securely captures the information required to initiate direct deposit or cash payments and authorize Check to process payment on their behalf.

Please note that once captured through Check Onboard, only the last four digits of a contractor’s Social Security Number (SSN) will be available through the Check API.

First, generate a one-time Onboard link for the contractor. Note that the contractor’s name and email address are not included in this call, as they were captured when creating the contractor resource.

Use the returned URL to redirect the contractor to the Check Onboard workflow. All requests to generate Onboard links should be server-side.

Create contractor onboard link

curl -X POST https://sandbox.checkhq.com/contractors/{contractor_id}/onboard \

-H 'Content-Type: application/json'

-H 'Authorization: Bearer {API_KEY}'Note: Onboard links are active for 24 hours, and may be regenerated if required.

Clicking the link will launch the Check Contractor Onboard flow.

Check Onboard captures the following information when onboarding contractors:

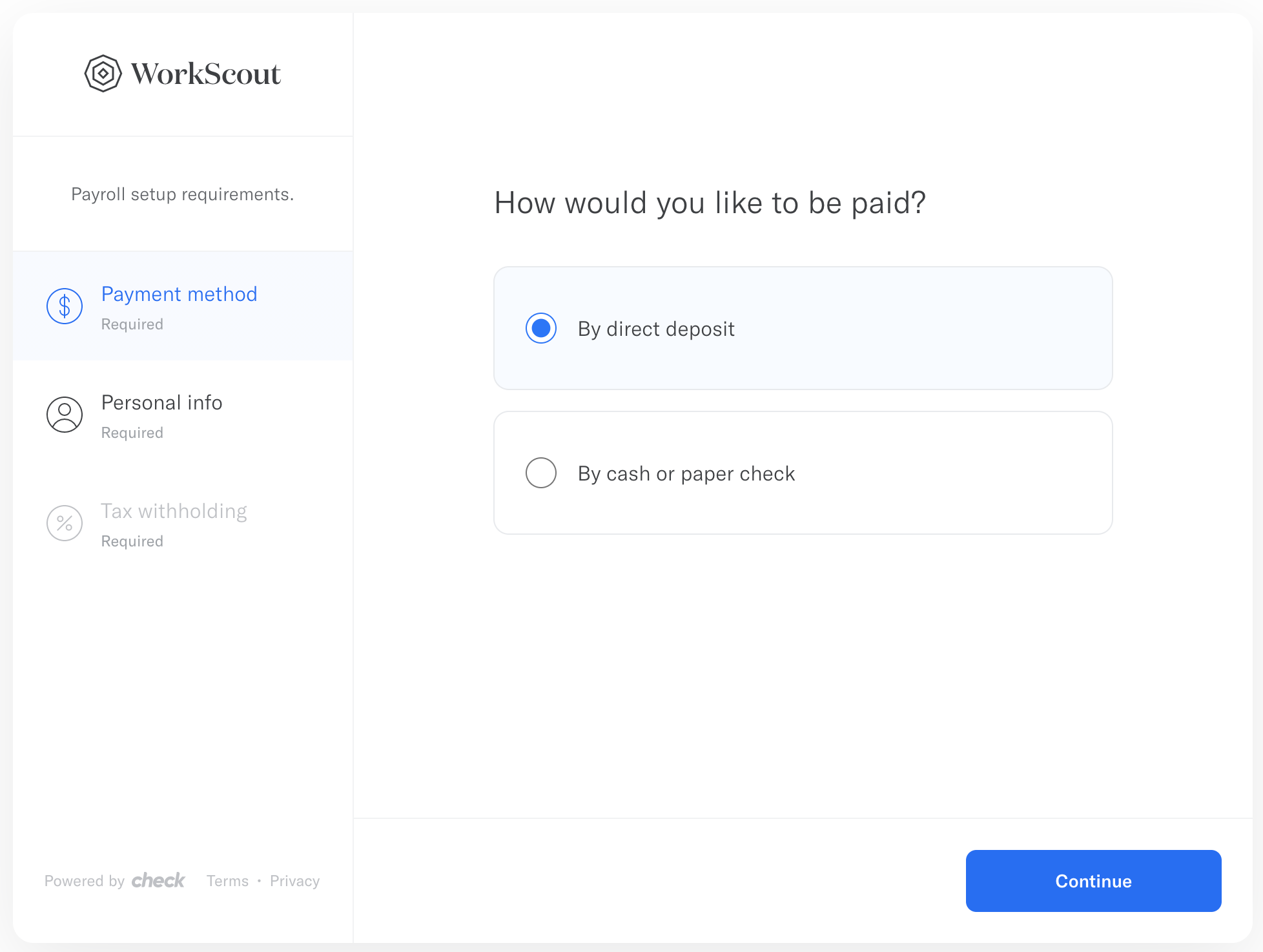

- Provide Identification Number: Contractors can either contract as an individual or as a business. In this step, contractors will choose whether they are an individual or a business, and we collect different information depending on what they select. If they are contracting as an individual, contractors will be asked to enter their SSN or their Individual Taxpayer Identification Number (ITIN) if they don’t have an SSN. If they are contracting as a business, contractors will be asked to enter their Legal Business Name, along with their Federal Employer Identification Number (EIN).

- Payment method: Users are asked to select manual (cash or check) or direct deposit payments. If they select manual, they are asked to certify that their employer has agreed to pay them directly. If they select direct deposit, they are asked to submit their banking information and authorize Check to process their paychecks. They are also notified that their routing information is encrypted and secure.

- Sign W-9: Users are asked to review and complete a federal W-9.

After completing the required fields, users are notified that they may return to enter any desired changes.

When completed, Check Onboard will create the Bank Account object, and associate it with the contractor. Check will also populate either the ssn_last_four or business_name and ein attributes in the Contractor object, depending on the contractor’s type.

If a contractor has not yet completed Check Onboard, you will still be able to create payroll resources for them. However, if they have not submitted direct deposit information, they will need to be paid manually (by cash or paper check), and if they have not submitted their TIN, they will not be able to be paid.

After onboarding

After the company and its employees and contractors have been onboarded, you are ready to run payroll for that company! You can view the Quickstart or API reference to learn more running payroll.

Updated 4 months ago