Bank Account Validation

In order to ensure the highest possible payment success rates, Check validates bank accounts that are created in our system. This applies to Company bank accounts as well as Employee and Contractor bank accounts.

How validation works

There are two ways a Company, Employee, or Contractor can connect their bank accounts to Check:

- by using Plaid — this is called a plaid_bank_account

- by providing routing and account numbers — this is called a raw_bank_account

Plaid bank accounts

Plaid bank accounts are automatically validated by Plaid. They can be created by employers and employees directly within Check Components, or they can be created programmatically by passing Check a Plaid processor token that you have obtained for an account linked through your Plaid integration.

Check does not need to do any further validation of these types of accounts, and for this reason it's the most seamless way of creating a bank account in Check.

Raw bank accounts

Raw bank accounts are created in Check by simply passing us the account and routing numbers of the account. Validation for raw bank accounts differs between Company raw bank accounts and Employee / Contractor raw bank accounts.

For Company raw bank accounts, Check will initiate validation as soon as they are created by sending an ACH prenote, or a $0 test payment, which is not visible to the account holder. While Check waits to hear back about the result of a prenote, the bank account will be in a status of validation_pending. Once the prenote succeeds, the bank account will enter a status of validated.

If the payment fails (which typically happens within 3 banking days), then the bank account moves into a disabled_irrecoverable status. This status indicates that the bank account is not able to be used on active payrolls. Check assumes that the account is valid unless this $0 transaction fails.

For Employee and Contractor raw bank accounts, Check will not perform any upfront validation. The bank account will immediately go into a validation_pending status, and will become validated once it is successfully used for a payroll direct deposit (or disabled_irrecoverable if the payment attempt to the bank account fails).

Validations in the API

The status and disabled_reason fields in the bank_account object and bank_account webhook can be used to determine the validation state of a bank account.

Bank accounts can be used to process payroll as long as they are not in a disabled state. This means that

- Bank accounts cannot be used in payroll if status is

disabled_recoverableordisabled_irrecoverable - Bank accounts can be used for payroll if status is

validation_pending,validatedorownership_verified

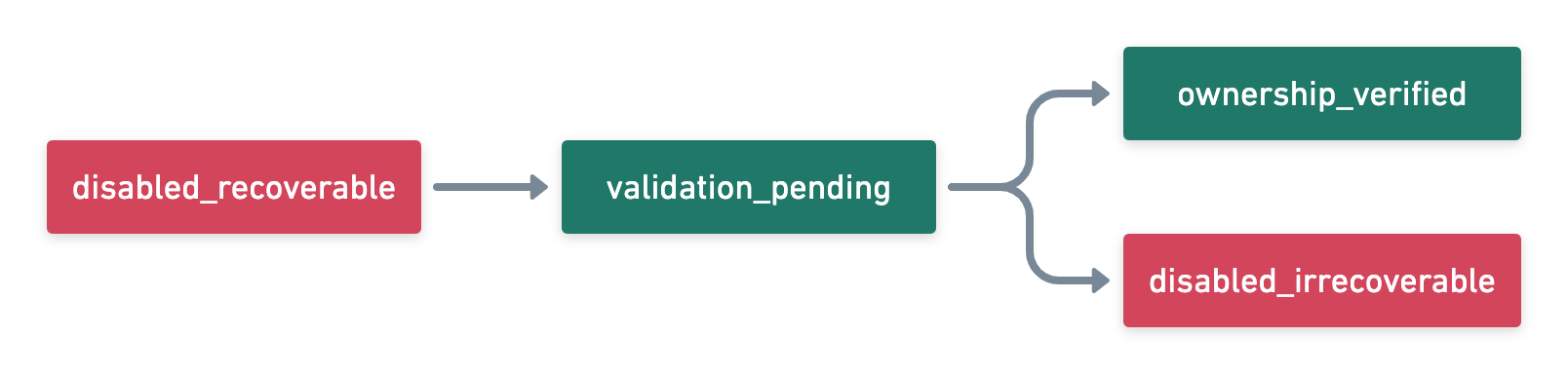

Company bank accounts

Company bank accounts start off in a disabled_recoverable state, then move to a validation_pending state. The bank account will move to an ownership_verified state if validation succeeds or disabled_irrecoverable if validation fails.

Company bank verification flow

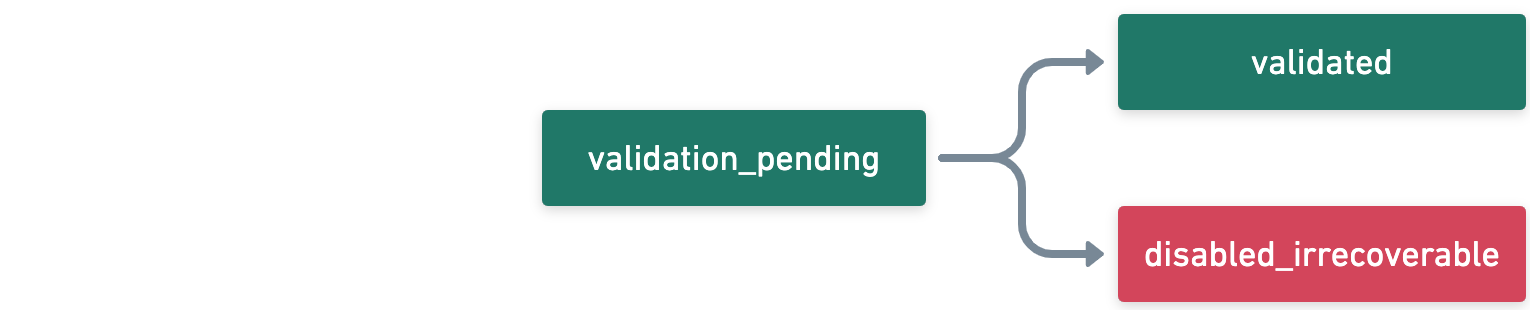

Employee and contractor bank accounts

Employee bank accounts start off in a validation_pending state and can move to validated once successfully used for a payroll direct deposit, or disabled_irrecoverable if a payment attempt fails.

Employee and contractor bank verification flow

Failure reasons

When bank accounts are disabled, you can tell users the reason the account is disabled by looking at the value of the disabled_reason parameter. Possible values here include:

validation_failed: the bank account failed our validation process and a new bank account must be providedfailed_payment: an attempted payment to this bank account has failed and a new bank account must be provided

Documentation around the values these fields can contain can be seen in our API reference here.

Recovering from failed validations

Bank account validation failures happen when incorrect bank account information is provided. When bank account validation fails, the bank account is moved to a disabled_irrecoverable state and any attempt to move money in or out of the account will result in the payment being rejected by the bank.

In order to recover from this status, the account must be replaced with a new bank account provided by the user. This new bank account will be validated as soon as it is created in our system.

Notifications of Change

Sometimes, when Check sends ACH payments on behalf of partners and employers, the Receiving Depository Financial Institution (RDFI) may return a Notification of Change (NOC). A NOC is a courtesy notice provided by the RDFI, which means that the payment was processed successfully, but some piece of account information needs to be corrected before the next payment to avoid future delays or returns. Check automatically handles NOCs and updates bank accounts in our system automatically. For more information on this, please see Notifications of Change (NOCs).

Testing in Sandbox

In sandbox, company bank accounts are automatically set to ownership_verified and employee bank accounts are automatically set to validated. You can test different statuses by:

- Setting the routing number to

000000000:- If it is a company bank account it stays in a

disabled_recoverablestatus withverification_pendingas the reason. - If it is an employee bank account it stays in a

disabled_irrecoverablestatus withvalidation_failedas the reason.

- If it is a company bank account it stays in a

- Setting the routing number to

111111111:- If it is a company bank account it goes into a

disabled_irrecoverablestatus withvalidation_failedas the reason. - The same thing goes for employee bank accounts.

- If it is a company bank account it goes into a

- Setting the routing number to any other value in the correct 9-digit format, will automatically set the accounts to either

ownership_verifiedorvalidateddepending on whether they are a company's or an employee's account.

Updated 2 months ago